Deregulation – Financial Freedom for the One Percent!

Posted on April 8, 2023

To understand the pitfalls of regulation, you need the ability to define it: Deregulation as I see it, is the process of removing government restrictions on industry and allowing it to operate with freedom from regulations. While some (mostly dodgy) people believe that deregulation will stimulate economic growth, others argue that it has catastrophic consequences. This includes harm to public health and safety, environmental damage, and economic/political instability.

The Jenga Scenario

So, why do I regard a push for further deregulation since removing ourselves from the EU as being a brainless ideology? The best description I could plagiarise from somewhere else, is this. Imagine you’re playing a game of Jenga (if you remember Jenga?). You’ve built the tower, and it’s your turn to remove one from the bottom. You know that if you remove the wrong block, the whole bastard lot will come crashing down (it always seemed to be me).

Deregulation is a bit like playing Jenga. Removing too many regulations too quickly, destabilises industry, causing it to wobble and ultimately, collapse (Google ‘Liz Truss economics’ and try not to be sick). Just like removing the wrong block can cause the Jenga tower to collapse, removing sensible regulations causes an economy to fail. Get it?

The Financial Industry

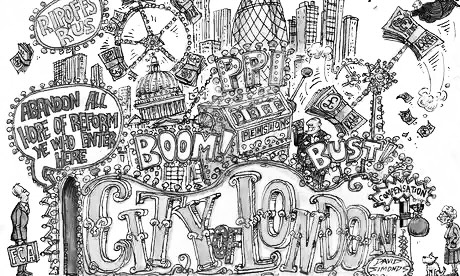

So, let’s take a butchers hook at the financial industry, an unleashed basket case full of narcissists if there ever was one. In the 1990s and early 2000s, the financial industry was aggressively deregulated. This allowed banks and other financial institutions to take on more risk. The result was unregulated lending causing the housing bubble to burst and the subsequent financial crisis of 2008. It had devastating effects on the global economy. Fortunately, none of the people behind aggressive deregulation went to prison and they all got to keep their money; which was nice.

Many will argue (including me) that in America and the UK, the crash didn’t end there. It was just the start. Austerity then crushed people who were already struggling to survive. This led to understandable distrust in the established order of banking and government. Populists seized the opportunity to prey on the ill-informed with simplistic answers to complex questions along with conspiracy theories about the deep state. This led to Brexit in the UK, and, along with America, witless, narcissistic leaders taking over once respected democracies. All very 1930’s.

Carpetbaggers

So, in conclusion, while some people still argue that deregulation is a good thing, it’s important to consider the potential consequences. Just like playing Jenga, you never know when the tower might come crashing down. And when it does, it ends up in chaos, with chancers seizing the opportunity, whilst not caring one jot about the country they are tearing apart.

Britain in 2023, is a result of the financial crash in 2008 and David Cameron giving the populist lunatics the chance to exploit it. Offering a referendum in return for backbench votes was about as traitorous as it gets. Cameron didn’t want Brexit to happen but he facilitated it, make no mistake about it. Now we have a government full of carpetbaggers and fascists. They are challenged by an opposition with an ideology that appears to be based on nothing more than being not quite as bent as the Tories.

Deregulation Revolution?

It’s the fault of deregulation we are in this mess and it is a tragedy that is beyond repair without a change in political direction. A system where the wealth continually gets sucked to the top as the poor get poorer will end terribly. Because of our archaic political system and a large proportion of the populace still hopelessly addicted to serfdom, a bloody and chaotic revolution still seems unlikely.

However, whilst we are not like the French, there is growing dissent towards the rich getting all the financial breaks whilst the poor queue for basic food. When the tipping point arrives and the pitchforks come out, it is a tipping point that will be hard to reverse. For some, a full on revolution is a dream. Personally, I’d rather we had a structured change with fairer distribution of wealth and properly funded public services.

Maybe it’s revolution or nothing?

*Our current PM made millions from deregulation, before, during, and after the banking crisis.

Got something to say?