Google Tax Bill

Posted on January 25, 2016

When I was looking like a retard on a cross trainer at the gymnasium this morning, I couldn’t help but notice on the screen in front of me someone talking about Google and a corporation tax settlement of £130 million that is to be paid to the HMRC.

There was a horrible patronising woman MP on the programme (called something like Penelope Cameron-Puppet) claiming that a payment of £130 million on profits dating back to 2005 was something of a result for the HMRC and that the Government more or less deserved a round of applause for their sterling efforts.

She even claimed that the British public were a little naive and were confusing Google’s turnover with profit when they were quoting financial figures. Basically, she was saying we are all a bit simple and that we don’t really understand what corporation tax actually is. This particular government policy of patronising behaviour annoys me nearly as much as the tax dodge.

As any small or medium sized business knows, corporation tax is a tax on your annual profits set at a rate of 20%. Most people will be paying this for their accounts dated April 2014 to April 2015, this week (due 31st January 2016). There is no choice in the matter, you pay it or you get fined, then fined again and then, eventually, if you still refuse to pay up, imprisoned.

It’s the law you see, so when the tax man is screaming that he wants his dough…you pay.

Unfortunately, unlike Google, you can’t take the HMRC to Claridges and thrash out a deal that you personally, would deem would be fair game under the circumstances. Imagine that? You get a bill for £10k, so you take John from the HMRC for a pie and pint (and maybe a lap dance or two) and hey presto, he tells you a grand should cover it before giving you a wink and a friendly punch on the upper arm and disappearing for another year.

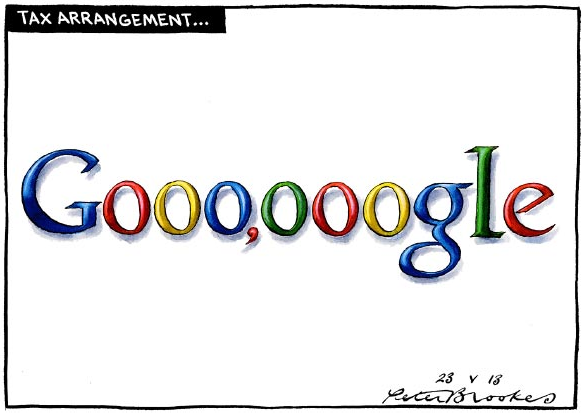

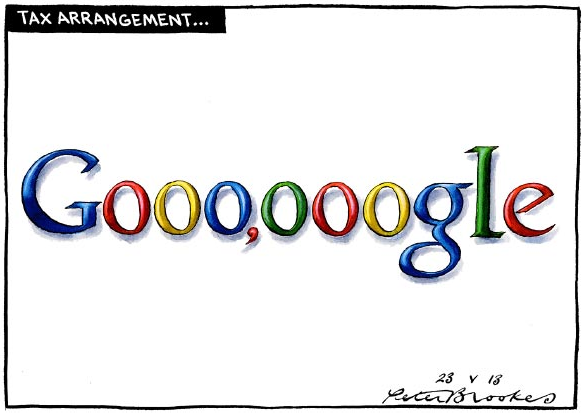

The crux of the matter is that most taxation experts have calculated that Google have avoided around £1.6 billion in corporation tax since 2005 and this is what our chancellor has to say regarding the matter.

“We’ve got Google to pay taxes and I think that is a huge step forward and addresses that perfectly legitimate public anger that large corporations have not been paying tax. I think it’s a really positive step … I think it’s a big step forward and a victory for the government.”

Oh do stop George…2.77% is not a major step forward mate, it is an insult to any business, large or small, who will be paying their 20% corporation tax on the 31st January, me being one of them.

I am not going to go all Marxist you and claim I enjoy paying corporation tax as my patriotic duty as a British citizen but I will pay it as I have to; I have no bloody choice and the same applies to every other company I deal with, often with gritted teeth as they digest the fact they are paying more than Facebook.

What really gets me is that it is seen as a victory to get a company to pay 2.77% of profit rather than the percentage rate of 20% stated in law as the corporation tax rate in Great Britain. I just can’t swallow that…how more black and white does the taxation law have to be for Christ’s sake?

Successive governments (including the New Labour shysters and the present day self-serving Tories) have allowed the tail to wag the dog time and again, giving the likes of Google, Amazon, Starbucks and others, the ability to laugh in the face of legitimate businesses who pay taxes according to the law of their land.

Suffice to say, it pisses me right off so it does.

Kirsty

January 25, 2016 (7:12 pm)

Just when I’d calmed down about this, you go and publish this!

Craig Killick

January 25, 2016 (7:30 pm)

Although I agree – it is a pile of shite in terms of social responsibility – a lot of large corporations negotiate their tax bills – rightly or wrongly. I guess part of this is any government making sure we don’t lose these companies to other countries. The global economy is just that. Law firms, retailers, will compete with businesses in Mumbai and beyond.

That said, us users still use Facebook, Twitter, Amazon, etc. so our right to moan (in my opinion) is somewhat diluted.

Although it is wrong morally, and as both sides spout figures out to back up their arguments, I can’t help thinking it’s slightly more complicated.

Which takes the power away from Governments and places it into the hands of corporations, relying on their morals. Then, just to complicate it even further for us plebs on the street, many Pensions have shares in these companies. I think my head is going to explode.

A few months ago, when Mark Zuckerburg told the world what a great guy he was for giving away so much of his business – he was lauded. Even though Facebook are one of the worse culprits for corporation tax in the UK.

I am just as bad. I buy from Amazon, I post to Facebook and Twitter (on my Apple devices) and I use (and make money from) Google.

The whole argument leaves me somewhat confused.

Bob Lethaby

January 25, 2016 (7:43 pm)

Craig,

I agree with some of your sentiment…I use Facebook, Google and Twitter, although I avoid Amazon and Starbucks as there are alternatives.

In fact I got some of my info for this blog on Google…Google is great but it shouldn’t excuse it paying tax.

Like you I get confused but the best way I summed it up was ‘the tail wagging the dog.’

It would be a start if the EU operated with corporation tax law where the rate was the same across Europe?

Do you remember that Vid I posted from TED last week…that is very relevant here…we are led to believe that without these big job creators, we might as well starve.

Nick

January 26, 2016 (6:54 pm)

Boycott is the answer and I don’t mean Geoffrey (although having him chasing down tax dodgers is an interesting prospect). From my youth I vaguely remember being advised not to bank with Barclays (South Africa links) or buy from Nestle (exploitation of breast feeding mothers in India). I think both campaigns brought change despite being based on A5 leaflets randomly placed on trains etc.

In today’s connected world it should be much easier to organise a boycott if there is enough will. Starbucks would seem to be easiest as there are always alternatives and frankly we can all survive without a coffee, despite what they would have you think. Amazon is a little harder, especially for us people who live in the middle of nowhere. And google is almost impossible to avoid as it seems as ubiquitous as water.

Bob I think you are just the man to lead us. Let’s pick a target and start a boycott. We need a compelling narrative for our choice and some creativity in the way it is presented. And then we just let the magic of social media do its thing.

PS The derivation of the term ‘boycott’ is an interesting story in itself and worth a blog